| |

Introduction

Cash. It’s what we all strive for. It’s what we all want in our pockets either literally or figuratively. And most importantly, cash is what businesses need to be mindful of in order to be successful.

Cash is the lifeblood of any business. Yet many companies do not bother to project it, and many that do miss their forecasts significantly. When done correctly, cash forecasts are powerful management tools that go well beyond simply projecting cash balances. They can dramatically improve a company’s operations, and affect strategic interests such as capital spending projects, or plans to increase revenue. Well-run companies are known for their accurate cash forecasts. This allows management to measure efficiency and performance in addition to predicting cash flow.

The 13-Week Cash Flow Projection

The forms of cash flow forecasts are only limited by management’s needs and the company’s ability to produce reliable data. At The O’Connor Group, we typically use a 13-week cash flow forecast for our clients. It is a critically important tool in managing a business suffering from poor results and/or poor liquidity. However, we also produce these forecasts for clients who are growing rapidly – they are powerful tools for all companies, regardless of situation.

The 13-Week Cash Flow is very different from a GAAP Statement of Cash Flow - it is simply a measure of cash in/cash out for a 3-month period. With effort, most companies can accurately forecast for their next quarter, and measuring weekly gives management regular feedback whether or not its assumptions are proving correct. In addition, the forecast also projects Working Capital accounts such as Accounts Receivable, Inventory, and Accounts Payable. This highlights intra-month liquidity needs, which can be particularly important for companies that realize significant revenue at the end of each month.

This model measures much more than cash flow, including:

- Operating Efficiency

- Cost Savings Opportunities

- Liquidity Needs

- Borrowing Needs/Paydowns

- Ability to increase Revenue with existing Capital structure

- Areas for operating improvement

- Future potential pitfalls

The forecast is also very flexible – you can conduct an infinite number of “what-if” scenarios allowing management to consider and pursue different opportunities available to it. An added benefit is that measuring actual results against the forecast is quick and easy to do.

Forecast Example

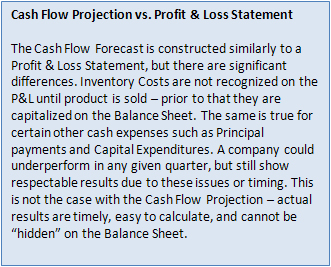

A truncated version of an actual forecast is below. There are three sections: Operating, Non-Operating, and Working Capital. The accounts included in each of these sections are self-explanatory. Separating the forecast this way provides for detailed analysis of the company, as discussed below. It is constructed like a Profit and Loss Statement in many ways, with some Balance Sheet data included as well (see sidebar). A key advantage over the P&L is timing - the cash flow only measures cash movements, so results are calculated quickly and easily.

<Cash Flow Projection spreadsheet included in PDF DOWNLOAD>

Evaluating the Forecast

The above forecast showed the following:

- Operating Section

- The Company was growing during the period, as Revenue was higher than Collections

- Operating Cash Flow was positive

- Every dollar of Operating Disbursements generated $1.38 of Revenue

- Non-Operating Section

- The Company planned to pay down non-Revolver bank debt by selling assets worth $220k

- The company was highly leveraged, with Principal and Interest payments totaling 7% of Revenue

- Every dollar of Total Disbursements generated $1.19 in Revenue

- Working Capital

- Availability under the company’s Revolver improved $155k

- Accounts Receivable increased $684k

- Inventory decreased $542k (due to seasonality)

- Accounts Payable remained constant

Analyzing the three sections together raises some questions and concerns for management. For instance, the combination of A/R growth and reduced Inventory indicates revenue is seasonal, and the company is in the midst of its selling season. Increased liquidity, cash flow, and profitability during these months are normal, but are these levels high enough? In addition, the company is not making payments to reduce A/P, which may not be a feasible assumption, particularly since the company experienced a significant increase in A/P prior to entering into its selling season.

In this particular case, management and ownership saw that the projected liquidity would not be enough to carry the company through its slow season, particularly because it would damage relations with trade vendors. They were able to improve the situation by aggressively selling slow-moving Inventory to improve sales, pro-actively cutting expenses, and making a small loan on a subordinated basis.

Conclusion

Accurate cash flow forecasts are useful and powerful tools for management. In the above example, ownership had no idea of the significant issues facing their company until a 13-Week Forecast was prepared. The company reviewed it, identified potential problems, took proactive measures, and avoided a crisis that they previously had not known was coming. |