| |

"There are three things extremely hard: steel, a diamond, and to know one's self."

- Benjamin Franklin

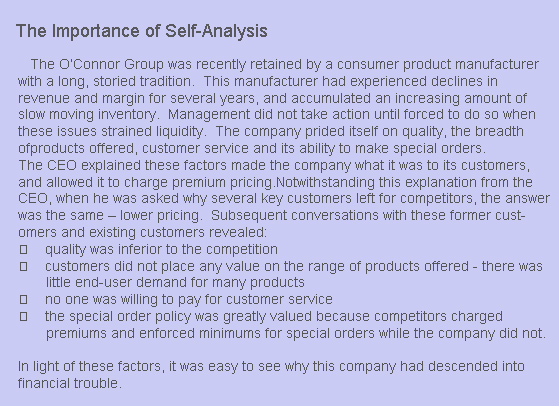

Itís a familiar story that plays out every day Ė a long-standing business closes without warning, leaving employees, creditors and the community dealing with the fallout. However, what appears sudden from the outside is actually years in the making. Most firms that fail could have avoided their fate if only management considered Mr. Franklinís wisdom, and acted accordingly.

Warning signs for failing companies are there for anyone willing to look for them. Early recognition can mean the difference between failure, a painful turnaround, or a minor course correction. A company that knows its core competencies and its environment is far less likely to fail than one that does not. Some warning signs are discussed below.

Adverse Trends

Adverse trends can mean just about anything negative, but particular consideration should be given to:

- Declining margins

- Rapidly increasing debt

- Declining market share

- Declining reinvestment in the company

Declining Margins: Gradually declining margins are sometimes tough to identify – margins normally change month to month, depending on seasonality and product mix. Sometimes this variability can hide downward trends, particularly when the trend is not sudden. There is a tendency to compare recent financial results to the prior period or to forecast. When this happens, steady erosion can be missed for a significant period.

Rapidly Increasing Debt: When debt, say in the form of a working capital line, grows, that may signal growing revenue. This increased debt is repaid as this revenue is collected from customers. However, if the debt does not decrease, it is likely something is wrong. The revenue may be unprofitable, or the company may not be able to collect its accounts receivable. It’s also possible the company might have produced inventory it cannot sell.

Declining Market Share: Declining market share is very alarming – competitors have taken away customers. These competitors will presumably become stronger, and management may find itself in a vicious circle that could ultimately end with the company’s failure if it cannot change anything. Management needs to identify the root causes of the lost market share and correct them as soon as possible.

Declining Reinvestment in the Company: Ownership needs to use a portion of earnings to replenish its investment in assets and people. If ownership takes capital out of the business year after year, the ability of that business will gradually erode. Any erosion is years in the making, and gives a good indication of the owner’s willingness and ability to think long-term.

Bad Organizational Health/Bad Management

Both of these go hand in hand - one inevitably leads to the other. Some signs include:

Failure to Achieve Goals: When goals are not reached, it is critical for management to find out why. Forecasts and goals are based on assumptions, and these assumptions need to be constantly evaluated and used for management feedback. A company may reach goals for the wrong reasons, which is why successes need to be analyzed just as much as failures.

Absence of Controls/Metrics: All companies are collections of individuals with different abilities who need to be led towards goals aligned with their company’s interest. Management needs to have an overall plan that is achievable and can be broken down into quantifiable actions for employees. They need to evaluate these actions, and reward employees accordingly.

Unnecessary Complexity: Complexity takes various forms, including organization, production, geography, etc. Companies rarely suffer by keeping things as simple as possible. Complexity leads to critical issues falling through the cracks, inefficient production and processes, and employee and customer confusion. It also gives cover to unproductive employees and hides both unprofitable products and unprofitable customers.

Rapid Growth and Overexpansion: Some companies diversify into different industries simply to diversify or increase/maintain top-line growth. Expansion for its own sake is seldom a good thing, and management can find itself in markets it does not understand, or producing products/services without knowing the true costs.

Accumulation of Small Problems: This is usually a symptom of larger organizational problems. Small problems can add up, but management can usually solve them without great effort. However, effective organizations have capable employees throughout who take initiative and prevent these problems from taking place. When numerous small problems crop up, it is a sign there is a lack of capable employees, or that they are not empowered to take action.

Failure to Analyze and React to the Business Environment

Change is a constant in life and in business. Companies must be vigilant and stay in touch with their environment so they can incorporate it into their plans for the future. These changes can be technical, economic, political, legal, socio-cultural, or demographic.

Examples of businesses that did not adapt to change include companies such as Circuit City, Borders, and (pre-bankruptcy) General Motors. These companies failed, yet peers such as Best Buy, Amazon, and Toyota are still in business.

Conclusion

Many businesses hit rough patches and struggle for various reasons, but not all fail. A company that knows its own core competencies and its business environment is well positioned to not only take advantage of any changes in that environment, but to take appropriate actions to protect its business. The sooner the process begins, the greater the likelihood of success.

<PDF DOWNLOAD of this article.>

|