| |

The O’Connor Group (“TOG”) advises a diverse number of clients on an equally diverse set of issues. At the outset of an engagement we are often asked to outline a scope of work for resolving a known set of issues. Each situation is unique, but TOG adheres to the following general set of tasks:

- Identify critical issues facing a client currently and in the future

- Identify a company’s core business strengths

- (re)Align a company’s strategy with its core competencies

- Create tools to empower managers to improve company performance

Seeing an almost immediate ROI isn’t always possible, for many reasons beyond our, and the client’s, control. But it can happen, as demonstrated in this case study.

Case Study – NLCS

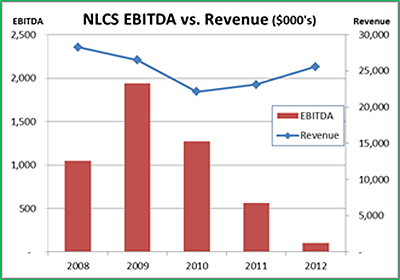

In late 2012, The O’Connor Group was retained by NLCS*, a family-owned and operated (2nd generation) pharmaceutical manufacturer that had historically achieved between $22 and $28 million in annual Revenue. EBITDA was declining in recent years, despite increasing Revenue. This led to strained liquidity and a strained banking relationship.

Fig 1 – NLCS’s financial performance, 2008 - 2012

NLCS Management and its lender were increasingly concerned about the profitability slide. The bank was particularly concerned that Management had no specific answers to explain the decline in performance, and corrective measures taken to date did not have any impact. The company defaulted under its Credit Agreement, and the lender decreased Availability under its line of credit and charged default interest rates. Both parties were negotiating a Forbearance Agreement when NLCS retained TOG.

TOG quickly identified the following issues upon starting the engagement:

- The banking relationship had grown somewhat contentious, and each party understandably decided a divorce was in its best interest;

- Relationships with Trade Creditors had been damaged by the company’s decreased liquidity;

- Information Systems were antiquated, and did a poor job converting data into usable information;

- All of NLCS’s products went through a similar production process; however, the time spent in each process varied widely. The company’s pricing model did not account for these differences;

- Prices for products sold to certain customers had not been raised in some time, despite steady increases in the price of raw materials;

- NLCS uniformly applied Manufacturing Overhead expenses across all products, a practice which made it impossible to calculate Gross Profit by product or customer;

- The customer base included several large national retailers with considerable pricing leverage over NLCS. These retailers made up a significant portion of NLCS’s Revenue.

One of the first tasks TOG undertook was to develop a 13-week cash flow projection. The projection showed no immediate need for outside capital provided NLCS could reduce Inventory and hold Accounts Payable constant. Trade Creditors were contacted in a pro-active manner to ensure the flow of Raw Materials would continue.

NLCS provided the cash flow forecast to the lender and reported actual results each week. This gave Management and the lender greater visibility into NLCS’s performance, and provided additional credibility for Management as it met plan. Management saw how precarious the company’s liquidity had become, and also saw the main drivers of liquidity. This caused an increased emphasis on managing cash more efficiently each day.

Identifying Core Strengths/Empowering Managers

NLCS had a workforce that was very skilled at manufacturing its products. Many workers had been long-term employees, and the COO was good strategically as well as tactically. Departmental managers were found to be capable as well. In addition, the information systems captured all kinds of relevant data that could be converted into usable information.

TOG and Management created a detailed annual budget for the company at Departmental levels. This budget allocated all expenses to appropriate departments, including those previously lumped into overhead. This created a set of metrics for measuring the performance of Departmental Managers. TOG also created an Activity Based Costing system that determined the actual costs associated with each production process. This meant that for the first time, Management could calculate how much each of its products (and customers) contributed to profitability.

Realign Strategy with Core Competencies

NLCS had a highly trained and capable workforce that it had invested in over a number of years. It was likely that the investment was greater than that of its competitors. It had also increased Inventory levels in order to provide better customer service. Despite this, NLCS mostly competed for business on price, rather than on quality.

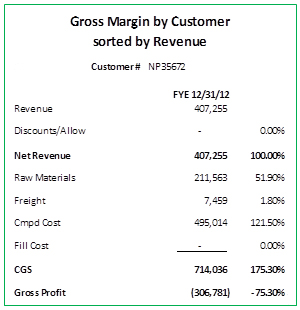

Fig. 2 – 2012 Gross Profit Margin Analysis by Customer

One of the more significant findings in analyzing NLCS’s 2012 performance was that the 11th largest customer that year (Customer #NP35672 – see above figure) accounted for $407k in Revenue, but over $714k of Cost of Goods Sold, for Gross Profit of ($307k). This customer made regular purchases throughout the year of only one type of product. After TOG completed this analysis NLCS increased this customer’s pricing by 270% in early 2013. By the end of the first quarter, this customer relationship had achieved positive Gross Profit.

Other significant issues included:

- NLCS provided free shipping to its largest ($4 million in 2012 Revenue) customer, a large national retailer. NLCS earned negative Gross Profit on this customer, primarily because of high Returns and Freight Costs, which accounted for $416k (10% of Revenue).

- The second largest ($3.6 million in 2012 Revenue) customer was also a large national retailer, and NLCS also earned negative Gross Profit due primarily to Returns of $331k (9% of Revenue).

- Further review revealed the abnormally high Returns and Freight expenses were mostly due to repeated shipping errors.

- Raw Materials expenses had increased by 580 basis points over the previous three years, but overall pricing policy did not change to reflect this.

As these reasons for NLCS’s losses became known, TOG and the Company worked to implement solutions, such as:

- A new pricing model incorporated the actual costs for each product, and a global pricing analysis was completed. Prices were immediately increased in cases where Margin was below standard;

- Freight operations were outsourced to an outside logistics consulting firm to reduce Freight costs and minimize incorrect orders;

- A hiring freeze was instituted which, combined with tighter controls on ordering Raw Materials, forced NLCS to become better at just-in-time manufacturing and caused it to achieve new manufacturing efficiencies;

- The new metrics and accountability in each cost center spurred cost containment initiatives at all levels of the company;

- While no layoffs proved necessary, TOG identified the optimal size of the workforce for various Revenue levels in case the company could not convert unprofitable customer relationships to profitable ones.

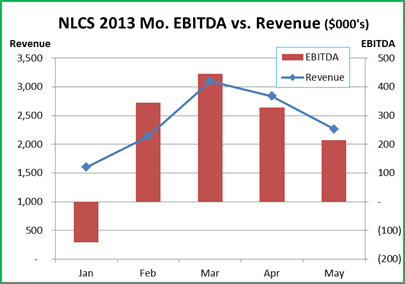

The company’s improved operations were seen almost immediately, as illustrated below:

Figure 3 – NLCS Revenue & EBITDA - 2013

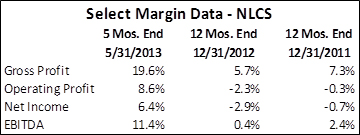

Figure 4 – Margin Data at March 31, 2013

TOG also created and distributed a Due Diligence package to prospective lenders outlining NLCS’s past issues, describing the corrective actions taken, and providing recent performance updates. Since the Company’s performance improved so quickly, several banks and non-bank lenders expressed interest in refinancing. By the end of Summer NLCS refinanced with a commercial bank. Today, the Company continues operating profitably, has positive relationships with its lender and all creditors, and readily takes advantage of business opportunities by utilizing its markedly improved liquidity position.

<PDF DOWNLOAD of this article.>

*The actual company name was changed to respect the privacy of the firm and its owners.

|