By some measures, today’s business climate has never been better – interest rates and corporate bankruptcies are at historic lows, the stock market continues setting records, and the credit quality of banks is at its highest point in years. On the other hand, GDP shrunk in the first quarter, inventories are at historic highs, the labor participation rate is at the lowest level in decades. What is causing such a disconnect? Have U.S. businesses achieved unprecedented efficiency than ever before, or is it something else?

Most businesses file for bankruptcy protection because they lack liquidity. There is a saying in the turnaround industry that with enough time and liquidity, any business can be salvaged. If time or money are no object, management will eventually stumble on the right plan. Obviously, this is not realistic, but the liquidity in the current lending environment helps explain the low level of bankruptcies.

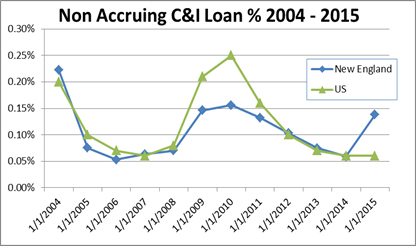

Fig 1 – Non-Accruing C&I Loan %

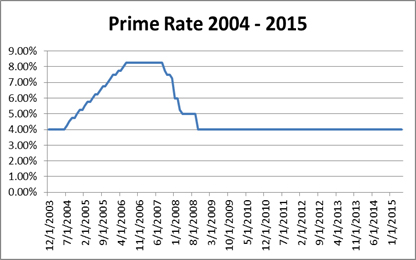

Low interest rates have been a boon to borrowers, but they negatively impact lenders through low net interest Income. Commercial Lenders also carry the added cost of complying with burdensome regulations implemented in recent years. Thus, low rates provide a powerful incentive for Lenders to pursue and retain relationships they would not have considered in the past. Lenders are simply using volume to offset low pricing.

Fig 2 – Prime Rate

This strategy influences Workout groups as well. Lenders are seemingly reluctant to take steps to inconvenience all but their worst-performing borrowers and they are putting a high price on retaining their loan outstandings. In reality, itís much easier to retain a borrower than replace one. Another outcome of low interest rates is that substandard financial performance does not necessarily trigger a covenant default. Low debt service requirements are more easily met, so even when a lender believes a borrower is likely to become an unacceptable risk, it may be prevented from taking action for a significant period of time. This can be a problem for the lender and the borrower: the lender because its risk of loss has obviously increased; and for the borrower because it will inevitably fail to make the changes necessary to improve the business. When this leads to a covenant default, it will find itself negotiating new terms with an unhappy (and impatient) lender.

When a business underperforms, timing becomes critical. The sooner changes are made, the higher the likelihood of success. Businesses do not fail overnight. They are usually years in the making, and there are usually many markers that are visible to anyone looking for them (click to see the article "Why Businesses Fail"). Traditionally, when borrowers violated a covenant (or were about to), lenders would require retention of a Turnaround Consultant despite misguided resistance from the borrower.

This has changed in recent years. Lenders are now more willing to extend additional credit to borrowers in hopes that, given another chance, management will finally be able to produce and implement an effective plan of action. One thing that has proven itself true throughout The OíConnor Groupís sixteen-year history is that when companies struggle, additional debt is almost never the answer. An inevitable result of todayís lending environment is that companies are able to avoid making hard choices because no one is forcing them to take drastic action. Temporary changes are seen as enough.

In our experience, very few management teams have the ability to change or come up with an effective strategy on its own. An objective third party is necessary to take a fresh look at the company and identify things such as:

- the true core business;

- the primary drivers of profitability;

- the competitive landscape; and

- the optimal capital structure.

Solutions can be found only after taking these first steps. Management and sometimes ownership (even if ownership is institutional) usually considers some cows to be sacred, which prevents a thorough, objective evaluation and plan. People naturally resist change, and besides, it is often unrealistic to expect those responsible for substandard performance to suddenly be able to correct it. Retaining a Turnaround Consultant is an effective way for management to come up with an effective strategy.

In recent years, an increasing number of The OíConnor Groupís clients have come from referrals from accountants, attorneys, and equity sponsors, with excellent results (see case studies here and here). This trend will continue so long as market pressures suppress lendersí ability to make money on their loans. The liquidity in todayís market makes this an actionable strategy for now, but what will happen when the pendulum swings the other way and liquidity dries up? Lenders with a reasonable exit strategy on paper may find themselves trampled by everyone else fleeing for the exits.

Exiting from a relationship every time a borrower has a bad quarter is obviously not the answer, but lenders do themselves and their customers a disservice when they allow substandard performance to continue instead of using their influence to force changes, however uncomfortable these may be. All bull markets end, and most end very badly. Companies led by management teams who only achieved mediocre performance may disappear when liquidity abates.

To learn more about you can help your clients get – and stay – on the right track, contact The O’Connor Group at 1-888-9-BIZ-FIX or email us at info@theoconnorgroup.com.

<PDF DOWNLOAD of this article.>

|